When it comes to choosing a banking institution, customers have options. That’s why building customer relationships fueled by real-time data and personalization in banking is more critical than never. Personalized relationships are at the heart of customer loyalty and satisfaction, and in the digital age, these relationships are increasingly driven by real-time data.

With the assistance of real-time data, banks are able to understand and respond to customer needs more promptly. Moreover, financial institutions are now able to create highly tailored, engaging experiences, all while building trust and connection.

Today, we’ll explore the myriad of ways that banks can leverage real-time data to enhance personalization and ultimately, create more meaningful customer relationships.

Why the Shift Towards Personalization in Banking?

The shift towards personalization isn’t confined to the banking industry but rather, as an overarching concept impacting all industries. More than half (52%) of consumers believe that as personalized digital experiences with brands become more personalized, satisfaction improves, according to research by Segment. Personalization isn’t only beneficial from a customer perspective — it can also have a tangible impact on your business’s bottom line.

McKinsey reports that companies can generate as much as 40% more revenue due to personalization. If your bank isn’t harnessing the power of personalization, it’s losing money.

Today’s customers know that businesses have the tools available to develop personalized experiences, and expect companies to deliver on those expectations. If they’re not met, customer satisfaction and loyalty can suffer.

The good news for businesses is that you don’t have to figure out personalization alone. Real-time data can help fuel successful personalization efforts that improve customer experience, drive loyalty, and result in increased satisfaction. (Want to learn more about how you can use generative AI to transform customer experiences? Check out this post.)

How can Data Play a Role in Creating Stronger Customer Relationships in Real Time?

Real-time data is the backbone of personalization in banking, and plays a critical role in creating stronger customer relationships. By utilizing real-time data, banks gain an in-depth understanding of customers’ behaviors, preferences, and needs. This enables the organization to deliver tailored, highly relevant experiences. Moreover, real-time insights gleaned from accurate, up-to-date data enables banks to make informed decisions and offer immediate responses to customer actions. This enhances the experience customers have with the bank, and builds up loyalty.

Here’s how real-time data integration and streaming make this possible.

Banks operate with a plethora of data sources, each contributing to a comprehensive understanding of their customers. Transactional data, for instance, offers detailed insights into customer spending habits, financial behaviors, and purchasing patterns. This data includes deposits, withdrawals, transfers, and payments, providing a real-time snapshot of a customer’s financial activities. Meanwhile, data from customer interactions, such as online banking sessions, mobile app usage, and in-branch visits, adds contextual information about the customer preferences’s service requirements, and engagement levels.

To effectively harness this data, banks utilize real-time data integration and streaming technologies. Real-time data integration involves the combination of data from multiple sources into a cohesive, up-to-date view. This process often employs Extract, Transform, Load (ETL) pipelines optimized for real-time processing. Data is continuously extracted from various sources, transformed into a uniform format, and loaded into a centralized repository, such as a data warehouse or a data lake.

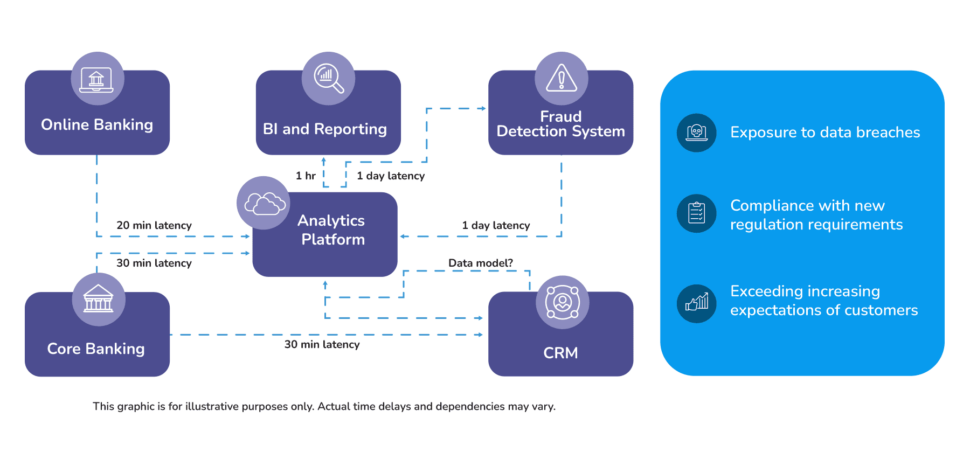

Here’s how siloed data negatively impacts operations in banking:

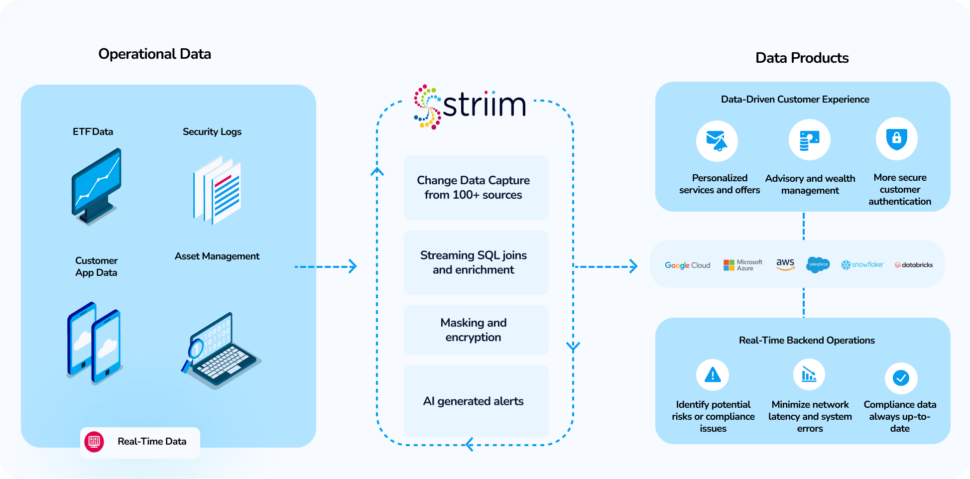

Platforms like Striim enable banks to process and analyze data as it is generated, which offers a myriad of benefits for banks from an operational and personalization perspective. For example, real-time fraud detection systems analyze transaction data in milliseconds, identifying and flagging suspicious activities as they occur. Similarly, personalized marketing engines use streaming data to offer tailored product recommendations and promotions based on the latest customer interactions and behaviors.

In the past, banking relied on batch processing and historical data. This led to delayed responses, a lack of personalized service, and frustration from the customer. In contrast, real-time data provides banks the ability to process and analyze information as it occurs. In the banking industry, immediacy makes all the difference, as it enables dynamic adjustments to customer interactions.

Ways to Leverage Real-Time Data for Personalization in Banking

There are countless ways banks can leverage real-time data to offer highly personalized experiences. Here are some of the most compelling.

- Customer segmentation: By continuously analyzing customers’ real-time activities including transaction types, spending patterns, and online banking interactions, banks can categorize customers into relevant segments. Examples of these segments include high spenders, frequent travelers, or online shoppers. These segments can then be used to tailor offerings the customer may find worthwhile.

- Personalized product recommendations: Banks can utilize real-time data to offer personalized product recommendations. By monitoring recent transactions and customer interactions, banks can identify specific needs and preferences at any given moment.

- Customer support: By monitoring customer activities such as transaction attempts, login patterns, and navigation within their apps or websites, banks can instantly identify and address potential issues. This enables proactive support before customers request help.

- Enhanced communication: Banks can also use real-time data to build highly targeted marketing campaigns and communications. To do so, analyze current customer behaviors and preferences to deliver relevant offers and messages.

Here’s a comprehensive look at how innovation with real-time data can propel financial institutions to the next level:

Take Personalization to the Next Level with Real-Time Data via Striim

Elevate your personalization initiatives to new heights with Striim. With its cutting-edge data streaming and integration capabilities, Striim ensures real-time processing with subsecond latency. Seamlessly capture data from diverse sources, streamline processing, and swiftly garner actionable insights to enable personalization efforts. Experience the difference firsthand with a free trial.