The key factor that makes real-time visualization preferable to batch or event-driven visualization is the requirement for immediacy of decision making, which tends to be role-based. A C-suite officer, for example, is unlikely to look at one visual representation of any data and change the strategy their company is taking.

Conversely, real-time visualization can be tremendously helpful to individuals who must make tactical or operational decisions on the fly.

But before looking at specific uses for real-time data visualization, let’s consider what kinds of use cases most benefit from visualizingin real time. They can generally be broken down into two categories:

- Those which allow individuals or firms to better deal with risk, both managing it and responding when something goes wrong

- Those which allow them to exploit rapidly emerging opportunities before they disappear

These circumstances, where action must be taken quickly, are where real-time visualizations shine in providing additional context for decision makers.

Use Case 1: Crisis Management

Perhaps the greatest value of real-time visualization in handling risk comes from informing decision makers who need to respond to emergent events. If a storm is on track to destroy a data center, retail outlet, or any part of a firm’s infrastructure or supply chain, for example, real-time visualization can be tremendously helpful.

Descriptive analytics delivered periodically do little for a decision maker concerned with getting customer services up immediately – by the time any analysis is available, the situation is likely to have changed.

Conversely, real-time visualization of assets in a variety of geographic locations allows decision makers to allocate resources where they’re needed most, which can be the difference between keeping and losing customers in industries where uptime is critical.

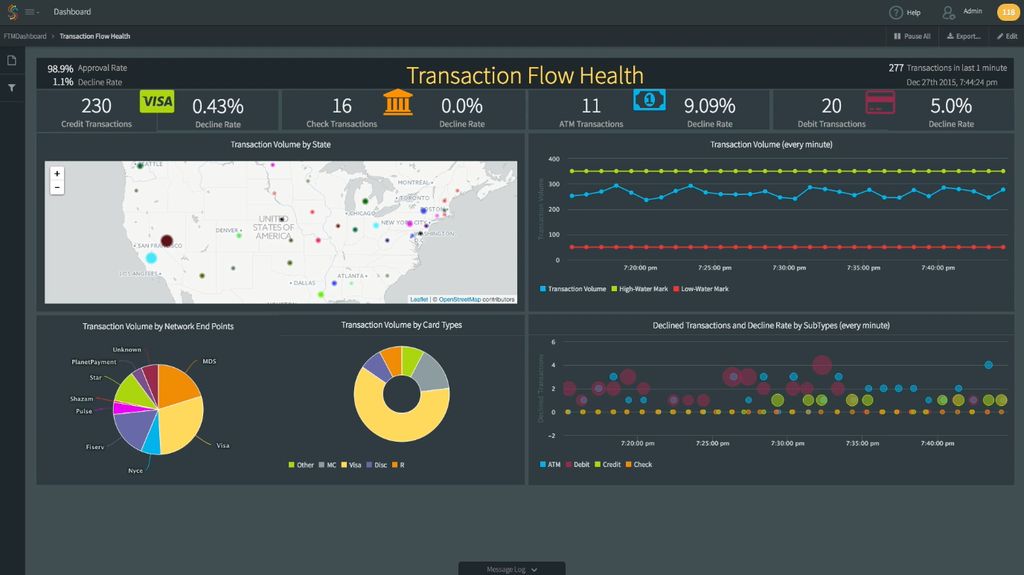

Use Case 2: Security and Fraud Prevention

In addition to giving firms options for responding to risky situations, real-time visualizations provide tremendous opportunity for reducing risk in day-to-day operations. The ability to centralize and visualize the output from all the sensors a firm has (for example, security cameras, burglar alarms, RFID tags on valuable assets, etc.) allows a single person to monitor billions of dollars’ worth of globally distributed property from one place.

This also makes it easier to find individuals who are attempting to defraud or otherwise steal from a firm before they’ve gotten away with it, because real-time visualizations can alert managers and decision makers to suspicious behavior before fraud actually occurs.

Use Case 3: Resource Management

This use case sits between risk and opportunity, and represents a unique chance for firms to maximize the value they get from existing resources.

Real-time visualization can aide managers in discovering inefficiencies and correct them long before legacy analysis would have signaled an anomaly. If, for example, a service vehicle goes out of commission midday, real-time visualization allows regional managers to react more efficiently and make better decisions with all the available information in front of them.

Use Case 4: Sales

Real-time data visualization opens up great opportunities for firms attempting to make more sales, both in brick-and-mortar institutions and in ecommerce.

Real-time analytics give firms the option to provide customers with contextual suggestions – for example, a supermarket suggesting a recipe using mostly ingredients already in a customer’s cart.

Combine this with more efficient inventory management (restocking hot items more quickly when they sell out), and real-time visualization gives firms a tremendous amount of flexibility to get more products out to consumers.

Use Case 5: Purchasing Decisions

For firms heavily reliant on the purchasing of commodities for their operations, the ability to visualize market trends in real time provides a great deal of added value. It means utilities can buy oil at its cheapest point, and international firms can capitalize on changes in foreign exchange markets rapidly.

Batch or event-driven visualization could have firms buying hours after prices hit their low, whereas real-time processing will alert firms to cheap inputs, resulting in huge cost savings.

Ultimately, firms across a wide variety of markets would do well to consider real-time visualization technology. Perhaps it won’t change their strategic direction, but operational optimizations have the potential to save real money.