Fraud is on the rise in the financial sector, with the Federal Trade Commission reporting a staggering $10 billion in losses for 2023 alone. This marks a 14% increase from 2022, underscoring the escalating threat of fraudulent activity within the industry. This increase can largely be attributed to the increased usage of instant transaction technologies and mobile payments. A growing reliance on instantly settled payments has upended how fraud impacts financial industries — but leveraging data more effectively can help detect and prevent fraudulent activities more effectively. Currently, many financial institutions are struggling with the diverse and widespread nature of data, sourced from numerous platforms and services. Effective fraud detection requires seamless integration and real-time analysis of this data. That’s where Striim and Snowflake step in. In this post, we’ll explore how integrating Striim with Snowflake can enhance your fraud detection capabilities, providing financial institutions the tools necessary to combat fraud in real time.

How Can Striim and Snowflake Help?

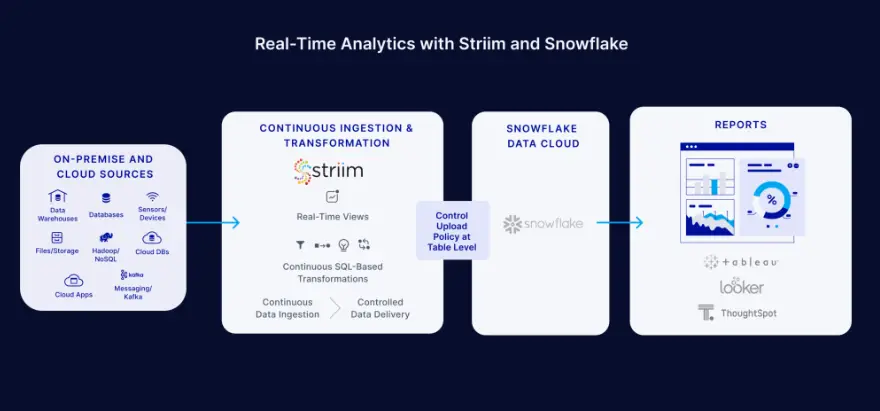

To better understand how integrating Striim and Snowflake can help, it’s helpful to first learn about each platform’s disparate capabilities. Striim is a next-generation Cloud Data Integration platform that specializes in real-time data replication and Change Data Capture (CDC). It enables seamless data integration from hundreds of sources, including popular databases including Oracle, SQLServer, and PostgreSQL (to name a few). Striim’s capabilities extend beyond CDC, offering hundreds of automated adapters for file-based data (logs, XML, CSV), IoT data (OPCUA, MQTT), and applications like Salesforce and SAP. Its SQL-based stream processing engine allows for easy data enrichment and normalization before writing to destinations like Snowflake. Because of this, Striim is a powerful product for financial institutions to leverage to empower effective fraud detection. Snowflake is a scalable data warehousing platform designed to support real-time analytics. It allows organizations to store and analyze large volumes of data efficiently, making it an excellent solution for institutions looking to increase fraud detection capabilities. Snowflake’s architecture separates compute and storage, enabling independent scaling of each and optimizing costs.

What are Challenges Financial Institutions Face with Fraud Detection?

Financial institutions face several challenges with fraud detection. Here are some of the most pressing obstacles that Striim and Snowflake can collaboratively address.

Data Volume

Processing large volumes of transactions in real time is a significant challenge. Financial institutions process millions of transactions daily, each requiring analysis for potential fraud.

Siloed Data Sources

The data required for fraud detection originates from diverse sources, including transaction logs, customer profiles, and external threat intelligence. Integrating and analyzing these siloed data sources is necessary for effective fraud prevention and seamless response if detected.

Response Time

Real-time detection and response to fraud are crucial for minimizing losses and protecting customers. Delayed detection can lead to significant financial and reputational damage.

Sensitive Data

Incorporating data from disparate sources often involves handling sensitive personally identifiable information (PII). Striim facilitates the integration of necessary data while ensuring PII remains secure at its source. Through in-memory processing, Striim enables analysis of only essential information, maintaining the integrity and security of sensitive data.

How Integrating Striim with Snowflake Helps

As financial institutions strive to protect customer assets and uphold trust, the integration of advanced technologies like Striim and Snowflake emerges as a pivotal strategy. Here’s how.

Real-Time Data Ingestion

Striim seamlessly ingests data from various sources and streams it directly into Snowflake in real time. This continuous data flow guarantees that the most up-to-date, accurate information is always available for immediate analysis.

Data Transformation and Enrichment

Striim enhances data quality by transforming and enriching it before it reaches Snowflake, ensuring high-quality data for analysis. This includes managing diverse data formats, performing necessary transformations, and enriching the data with additional context.

Real-Time Analytics

Snowflake’s robust capabilities for real-time analysis on the streamed data empower proactive fraud detection. Financial institutions can leverage Snowflake’s powerful query engine to analyze large datasets rapidly, ensuring effective fraud detection.

Use Case: Fraud Detection in the Financial Banking Sector

Picture this: Your financial institution needs to integrate data from various sources, including:

- Transaction logs stored in Oracle databases that are housed in 10 different data centers across the United States

- Customer profiles stored in a centralized Oracle database

- Third party real-time payment systems

However, these data sources are siloed, making it challenging to achieve comprehensive, real-time fraud detection and analysis.

This is where Striim and Snowflake can help. Striim facilitates real-time data integration from disparate data sources, while transforming and enriching data rapidly. Striim specializes in pulling data from large, fragmented datasets, which may be divided by department, location, or storage type.

While streaming data from these different sources, Striim can handle in-memory transformations using SQL or Java, allowing for custom logic to manage any necessary data transformations. Because these transformations occur in memory, there is minimal overhead in replicating your data into Snowflake. Striim can leverage both the Snowpipe Streaming API and the Snowpipe API, depending on the best use case for the source dataset.

Once the datasets are synchronized within Snowflake, you have two sources of truth: The original and target datasets. This setup enables the development of real-time fraud detection processes by leveraging continuously updated data in Snowflake. Snowflake offers extensive capabilities post-upload, including Snowpark ML and integrations with industry-leading data providers for customer transaction and risk data. As a result, your team enjoys enhanced fraud detection capabilities.

Integrate Striim and Snowflake for Enhanced Fraud Detection

Detecting fraud and understanding how it occurred is important — but unless fraud can be stopped in real time, it will continue to surge. Integrating Striim with Snowflake provides financial institutions with a comprehensive solution for real-time fraud detection, enabling seamless data ingestion, transformation, and immediate analysis.

By leveraging the capabilities of Striim and Snowflake, financial institutions can protect their assets and maintain customer trust through effective, real-time fraud detection. Explore how Striim and Snowflake integrate today with a demo.